Proposal No. 1: The election of the two Class II director nomineenominees named in this proxy statement, each to serve until the 20192022 Annual Meeting of Stockholders and until his or her successor is duly elected and qualifies.

Proposal No. 2: The ratification of the appointment of PricewaterhouseCoopers LLP to serve as the Company’s independent registered public accounting firm for fiscal year 2016.2019.

Proposal No. 3: The approval, on a non-binding advisory basis, of the compensation of the Company’s named executive officers, as disclosed in this proxy statement.

“FOR” ratification of the appointment of PricewaterhouseCoopers LLP to serve as the Company’s independent registered public accounting firm for fiscal year 2016.2019.

“FOR” approval, on a non-binding advisory basis, of the compensation of the Company’s named executive officers, as disclosed in this proxy statement.

If you hold your shares in street name, a “legal proxy” obtained from the broker, bank or other nominee that holds your shares authorizing you to vote your shares held in street name at the Annual Meeting.

the Class I directors are Messrs. Diaz and Mathes and Ms. Tolson, and their term will expire at the annual meeting of stockholders expected to be held in 2018;2021;

the Class III directors are Messrs. Male and Wender, and their term will expire at the annual meeting of stockholders expected to be held in 2017.2020.

presiding at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors;

serving as the principal liaison among the Chairman, any other non-independent directors and the independent directors to facilitate discussion of issues discussed in the executive sessions and to ensure the flow of information;

being available, if requested by major stockholders, for consultation and direct communication with stockholders;

retaining outside advisors and consultants who report directly to the Board on Board-wide issues; and

leading the performance assessment of the Chief Executive Officer and, in collaboration with the Nominating and Governance Committee, the Board’s self-assessment.

The Audit Committee of the Board (the “Audit Committee”), as part of its oversight role, is responsible for reviewing with management, the internal auditor and the independent auditor, the effectiveness of the Company’s internal control over financial reporting, disclosure controls and procedures and risk management procedures related to, among other things, the Company’s financial condition, the independent auditor, market and industry conditions, information technology security, including cybersecurity and disaster recovery, among other responsibilities set forth in the Audit Committee’s charter. With

The Compensation Committee of the Board (the “Compensation Committee”) monitors risks associated with the design and administration of the Company’s compensation programs, including its performance-based compensation, to promote an environment which does not encourage unnecessary and excessive risk-taking by the Company’s employees. See “Executive Compensation—Compensation Discussion and Analysis—Compensation Risk Assessment.”

The Nominating and Governance Committee assesses risk as it relates to monitoring developments in law and practice with respect to the Company’s environmental, social and corporate governance (“ESG”) processes, and in reviewing related person transactions.

the appointment, retention, termination, compensation and oversight of the work of the independent auditor, which reports directly to the Audit Committee, and the sole authority to pre-approve all services provided by the independent auditor;

reviewing and discussing the Company’s annual audited financial statements, quarterly financial statements and earnings releases with the Company’s management and its independent auditor;

reviewing the organization, responsibilities, audit plan and results of the internal audit function; reviewing with management, the internal auditor and the independent auditor, the quality, adequacy and effectiveness of the Company’s internal control over financial reporting, disclosure controls and procedures and risk management procedures;

reviewing with management material legal matters and the effectiveness of the Company’s procedures to ensure compliance with legal and regulatory requirements; and

overseeing the Company’s compliance program and obtaining periodic reports from the Co-Chief Compliance Officer.Officers.

reviewing and approving corporate goals and objectives relevant to Chief Executive Officer compensation, and evaluating the Chief Executive Officer’s performance in light of those goals and objectives;

evaluating and making recommendations to the Board regarding equity-based and cash incentive compensation plans;

adopting and periodically reviewing the Company’s philosophy, strategy and principles regarding the design and administration of the Company’s compensation programs.

in collaboration with the Lead Independent Director, lead the evaluation of the Board and Board committees;

an automatic annual grant of RSUs with a value of $120,000 based on the closing price of shares of our stock on the NYSE on the date of grant, which RSUs will generally vest one year from the date of grant, with dividend equivalents accruing on such RSUs in the amounts equal to the regular cash dividends paid on our common stock and such accrued dividend equivalents shall convert to shares of our common stock on the date of vesting; and

The Company’s Corporate Governance Guidelines provide that non-employee directors are expected to own shares of our common stock having a market value of at least three times their annual cash retainer within three years of becoming a director. This

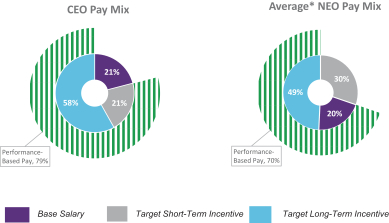

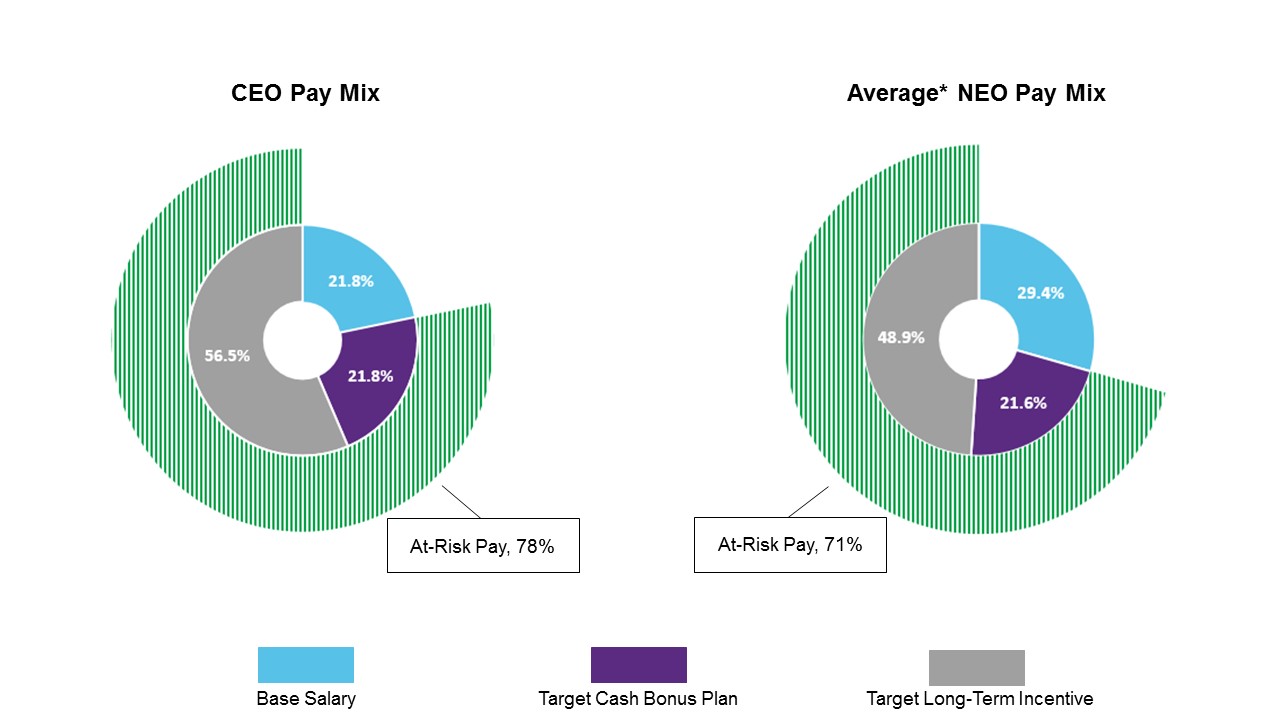

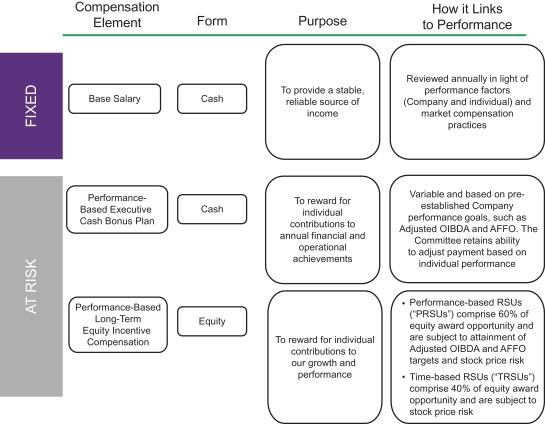

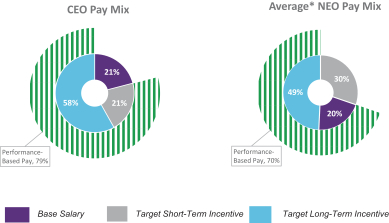

To help ensure

that management’s interests are aligned with those of stockholders and their compensation reflects the performance of the Company, a substantial portion of our NEOs’ compensation is at risk, and will vary above or below target levels commensurate with Company performance. The chart below shows the percentage of our NEOs’

20152018 target compensation that was

performance-based and at risk.

* Average includes the following NEOs: Messrs. Shassian, Punter, Sriubas and Sauer.

Resulting Changes to our Compensation Programs

Over the course of 2015, the Committee made a number of changes to enhance the alignment of our practices with the Company’s business strategies, and to better align with market practices.

| |

| | | | |

| | | Type of Change

| | Summary of Change

| | Rationale for Change

|

| | Adopted a Compensation Peer Group

| | ü Formally adopted the use of a compensation peer group comprising 15 similarly-sized publicly-traded media companies

| | ü Incorporate credible data sources on executive pay levels and practices

|

| | | | | ü Reviewed pay practices at similarly-sized REITs

| | ü Use the REIT industry practices as a secondary reference point for the general market with respect to executive pay practices, and not as a peer group

|

| | Adopted formal stock ownership guidelines for all executive officers

| | ü Executive officers are now required to own stock equal to a multiple of their base salary

| | ü Better align the interests of our executive team with those of our stockholders

ü Demonstrate confidence in the long-term performance of the Company

|

| | Adopted new performance metric under the Amended and Restated Executive Bonus Plan and the Amended and Restated Omnibus SIP

| | ü Replaced the free cash flow metric with AFFO

| | ü Incorporate an incentive metric that is used by management and is an important indicator of our operational strength and business performance, and is widely used by REITs

ü AFFO is a key metric used by our stockholders in analyzing our operating performance, and a key driver of stockholder value creation

|

| | | | | | |

| * | | Adopted changeAverage includes the following NEOs: Messrs. Siegel, Sriubas, Punter and Sauer. Includes the annualized value of Mr. Siegel’s target total direct compensation package pursuant to the terms of his employment agreement, and excludes (1) the value of Mr. Siegel’s one-time equity grant awarded in control provisionsJune 2018 in connection with entering into his employment agreement; and (2) the Amended and Restated Omnibus SIP and relatedvalue of Mr. Sriubas’s one-time equity awards terms and conditions and adoptedgrant awarded in November 2017 in connection with the CIC Plan | | ü The Amended and Restated Omnibus SIP (which was approved by our stockholders in 2015) and related equity award terms and conditions now include accelerated equity vesting upon change in control provisions forCompany renewing its contract with the benefit of all plan participants, with “double triggers”

ü ImplementedMTA. For further information, see the CIC Plan, effective January 1, 2016, providing non-equity severance benefits for our executive officers upon a change in control, with a “double-trigger”

| | ü Help retain our executive officers and key employees, and provide financial security to our executive officers and key employees in the event of a termination upon a change in control

ü Foster objectivity and cooperation should executive officers be asked to evaluate change in control proposals that may result in the loss of their employment, but may be in the best interests of our stockholders

section entitled “—Employment Agreements.” |

Summary of Our Executive Compensation Practices

The table below highlights certain executive compensation practices we have implemented that drive performance as well as those not implemented because we do not believe they would serve our stockholders’ interests:

|

| | |

| What We DO |

| ü | | What We Do

üTie pay to performance by ensuring thatdesigning a significant portion of executive pay is performance-based andto be at risk; 79%78% of the CEO’s 20152018 compensation is performance-based and, on average, 70%71% of the other NEOs’ compensation, is performance-based

at risk |

| | |

| ü | | Require significant stock ownership guidelines to ensure directors and executives have long-term stockholder alignment |

| | |

| ü | | Conduct an annual compensation program risk assessment |

| | |

| ü | | Mitigate undue risk in compensation programs through informed performance goal-setting that consideredconsiders multiple financial and non-financial inputs |

| | |

| ü | | Retain the services of an independent compensation consultant |

| | |

| ü | | Generally consider market and industry data when setting executive pay, using the median as a reference point to understand the general market |

| | |

| ü | | Provide for accelerated equity vesting for plan participants and non-equity severance benefits for our executive officers upon a change in control, with “double triggers” |

| | |

| ü | | Maintain an anti-hedging policy that prohibits our directors, executive officers, employees and their related persons from trading in derivative instruments with respect to the Company’s securities or selling the Company’s securities “short” |

| | |

| ü | | Prohibit our directors, executive officers and their related persons from pledging the Company’s securities as collateral for loans or for any other purpose except in limited circumstances, such as financial hardship, at the discretion of the Company’s General Counsel |

| | |

ü Require significant stock ownership guidelines | | Maintain a clawback policy applicable to ensure directors and executives haveexecutive officers in the event of a long-term stockholder orientationfinancial statement restatement |

| | |

What We Don’t Do×DON’T DO

|

| û | | Provide excessive perquisites ×

|

| | |

| û | | Offer a pension or supplemental executive retirement plan ×

|

| | |

| û | | Reprice underwater stock options without stockholder approval ×

|

| | |

| û | | Reward executives without a link to performance × Provide excise tax gross-ups

|

| | |

2015

2018 Say-on-Pay and Frequency of Say-on-Pay Outcome

We held a non-binding advisory stockholder vote on the compensation of our NEOs, commonly referred to as a “say-on-pay” vote, at our

20152018 Annual Meeting of Stockholders. At the

20152018 Annual Meeting of Stockholders, approximately

88%94% of the votes cast were cast in favor of the “say-on-pay” proposal. The Committee considered the result of this advisory vote to be an endorsement of our executive compensation program, policies, practices and

philosophy.philosophy, and did not make any compensation changes for our NEOs specifically as a result of the say-on-pay voting results. The Committee will continue to consider the outcome of our say-on-pay votes when making future executive compensation decisions for our NEOs.

In light of the voting results with respect to the frequency of holding a non-binding advisory vote on executive compensation, the Board has determined that the Company will hold future non-binding advisory votes of stockholders to approve the compensation of the NEOs every year until the next non-binding advisory vote of stockholders on the frequency of stockholder votes on executive compensation in 2021, or until the Board otherwise determines a different frequency for such non-binding advisory votes.

Evaluating

20152018 Compensation and the Use of Market Data

In

2015,2018, the Committee engaged ClearBridge to advise the Committee regarding the amount and types of compensation that we provide to our executive officers and directors and how our compensation practices compared to the compensation practices of peer companies. See “Directors, Executive Officers and Corporate Governance—Board Committees—Compensation Committee” for further information regarding our engagement of ClearBridge.

In making its compensation determinations for fiscal year

2015,2018, the Committee relied on publicly available information for a select group of U.S.-based publicly-traded media peer companies as the primary data source. The peer group was selected by the Committee based on recommendations provided by ClearBridge. The Committee expects to review and approve the compensation peer group annually. The compensation peer group was determined based on the following criteria:

| |

| ü | Business Criteria: companiesCompanies in the media industry with a meaningful portion of revenue from advertising sales as determined by an evaluation of such companies’ public disclosures. |

| |

| ü | Size Criteria: Companies comparable to the Company’s revenue size (for example, companies with revenue of $500 million to $3.5 billion), with a secondary focus on market capitalizationcapitalization. |

Based on these

| |

| ü | Peers of Peers: Companies listed as peer of the Company’s current peers as disclosed in such peers’ proxy statement. |

For 2018, the Committee reviewed the compensation peer group and removed Media General because it merged with Nexstar Broadcasting Group, Inc. in 2017 and formed Nexstar Media Group, Inc. The Committee added Entercom Communications Corp. because it met the selection criteria described above. Following these modifications, the comparisoncompensation peer group comprises the following 1514 companies: | | | | | | |

| | | | |

| | | Company | | Trailing 12-Month

Revenue(1) | | Market

Capitalization(1) |

| | | OUTFRONT Media Inc. | | $1,514 | | $3,004 |

| | | Time, Inc. | | $3,083 | | $1,720 |

| | | IAC/InterActiveCorp | | $3,110 | | $4,630 |

| | | Clear Channel Outdoor Holdings Inc. | | $2,836 | | $2,007 |

| | | Scripps Networks Interactive, Inc. | | $2,836 | | $7,098 |

| | | AMC Networks Inc. | | $2,511 | | $5,406 |

| | | Sinclair Broadcast Group, Inc. | | $2,221 | | $3,082 |

| | | Meredith Corporation | | $1,608 | | $2,221 |

| | | The New York Times Company | | $1,579 | | $2,173 |

| | | Lamar Advertising Co. | | $1,334 | | $5,794 |

| | | Cumulus Media Inc. | | $1,189 | | $77 |

| | | The Madison Square Garden Company | | $1,103 | | $4,041 |

| | | The E.W. Scripps Company | | $1,032 | | $1,594 |

| | | Nexstar Broadcasting Group, Inc. | | $842 | | $1,797 |

| | | LIN Media LLC (2) | | N/A | | N/A |

| | | AOL Inc.(2) | | N/A | | N/A |

(1) As of 1/4/2016. Dollars in millions.

(2) LIN Media and AOL underwent transactions in 2015, and are no longer stand-alone public

companies; Media General will be added for 2016. Dollars in millions. |

|

| | | | | | | | | | | | |

| Company | | Trailing 12-Month Revenue(1) | | Market Capitalization(1) |

| OUTFRONT Media Inc. | | | $ | 1,606 |

| | | | $ | 2,528 |

| |

| IAC/InterActiveCorp | | | $ | 4,263 |

| | | | $ | 15,053 |

| |

| Scripps Networks Interactive, Inc. | | | $ | 3,562 |

| | | | $ | 11,714 |

| |

| Sinclair Broadcast Group, Inc. | | | $ | 3,055 |

| | | | $ | 2,629 |

| |

| Meredith Corporation | | | $ | 3,047 |

| | | | $ | 2,366 |

| |

| AMC Networks Inc. | | | $ | 2,972 |

| | | | $ | 3,202 |

| |

| Time Inc. | | | $ | 2,775 |

| | | | $ | 1,843 |

| |

| Nexstar Media Group, Inc. | | | $ | 2,767 |

| | | | $ | 3,692 |

| |

| Clear Channel Outdoor Holdings, Inc. | | | $ | 2,722 |

| | | | $ | 1,914 |

| |

| TEGNA, Inc. | | | $ | 2,207 |

| | | | $ | 2,375 |

| |

| The New York Times Company | | | $ | 1,726 |

| | | | $ | 3,604 |

| |

| Lamar Advertising Company | | | $ | 1,627 |

| | | | $ | 6,683 |

| |

| Entercom Communications Corp. | | | $ | 1,463 |

| | | | $ | 848 |

| |

| The E. W. Scripps Company | | | $ | 1,208 |

| | | | $ | 1,304 |

| |

| Gray Television, Inc. | | | $ | 1,084 |

| | | | $ | 1,296 |

| |

| |

| (1) | As of January 2, 2019, except for Scripps Networks Interactive, Inc. and Time Inc., as both companies were acquired in 2018. Information for Scripps Networks Interactive, Inc. and Time Inc. is as of the last date that publicly available information was reported by these companies prior to being acquired. Dollars in millions. |

The Company strives to maintain a reasonable competitive positioning relative to the peer group and secondary compensation sources, such as published survey data. Although the Company does not use benchmarking to evaluate its

executionexecutive compensation, it does use market data as an initial reference point to understand the general market. Analyzed data is scoped to the Company’s revenue size and aged to a common date to ensure comparability. In

2015,2018, the Committee reviewed data from the

Willis Towers Watson Executive General Industry Survey and the

Willis Towers Watson Executive Media Industry Survey. No one company in these surveys was

dispositiverelied upon with respect to

determining any of the Company’s compensation decisions. Because the Company is structured as a REIT, the Committee also considered pay practices among

the following specialty REITs of comparable

size to that of the Company based on revenue and market capitalization,

similar to the

Company as a supplemental reference point:size criteria used for the media peer group described above. The REIT comparison group includes the following specialty REITs: Crown Castle International Corp.,

The GEO Group, Inc.,

Corrections Corp. of America,CoreCivic, Inc, Digital Realty Trust

Plum Creek Timber Co.Inc., Extra Space Storage Inc., and CBL & Associates Properties.

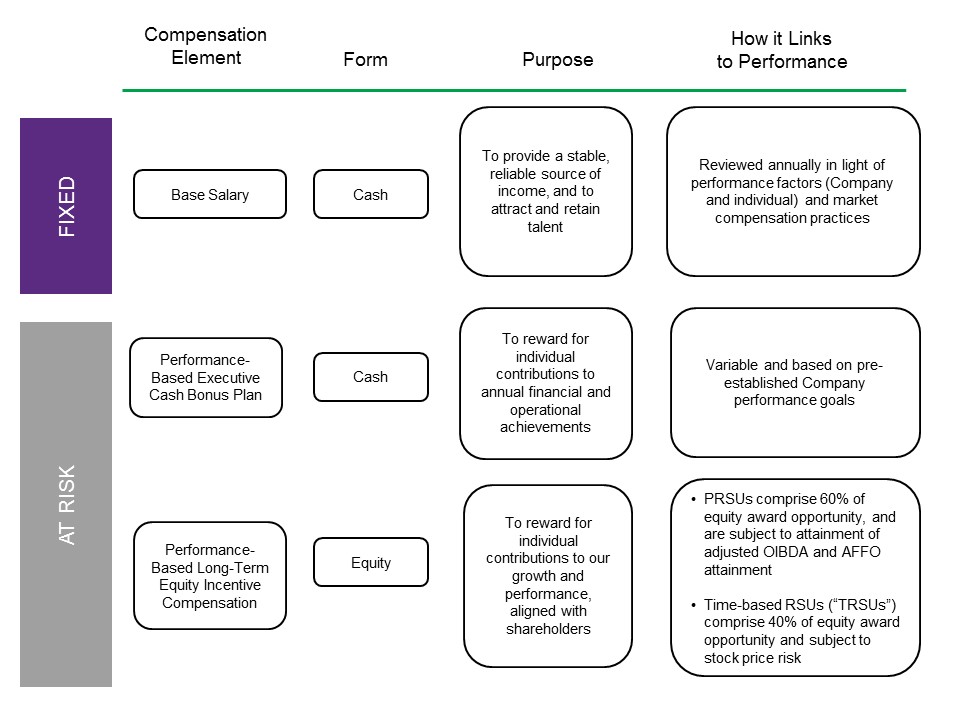

Elements of

20152018 NEO Compensation

Consistent with

2014,2017, NEO compensation included the following compensation elements:

| |

| ü | Performance-based compensation: |

◦Executive cash bonus plan

◦Long-term equity incentive compensation

| ¡ | | Executive cash bonus plan |

| ¡ | | Long-term equity incentive compensation |

| |

| ü | Other compensation (personal benefits) |

The Committee considered each of the above elements from the perspective of design and pay level as it reviewed and established NEO compensation in

2015.2018. Neither the Company nor the Committee used explicit guidelines in determining the mix of compensation elements for the NEOs. However, as described above, the Committee managed the pay programs so that a majority of compensation was both at risk and subject to performance conditions.

During

2015,2018, we were a party to employment agreements with all of our NEOs. For a description of the terms and provisions of these employment agreements, see “—Employment Agreements.”

We annually review the base salaries of our NEOs in light of performance factors (Company and individual) and market compensation practices. The Committee reviews compensation analysis and data provided by our compensation consultant, ClearBridge.

Messrs. Male, Shassian and Sauer

The Company entered into

an employment

agreementsagreement with

Mr. Siegel on May 24, 2018, which provides for his employment as the Company’s Executive Vice President and Chief Financial Officer from June 4, 2018 through June 3, 2021, with automatic one-year extensions if the Agreement is not otherwise terminated by the Company

in late 2013 and early 2014. Messrs. Sriubas and Punter entered into employment agreements with the Company in July 2014 and October 2014, respectively.or Mr. Siegel. The Agreement provides for an annual salary of $650,000. See “—Employment Agreements.”

The base salaries provided to

Messrs. Male, Shassian, Sriubas and Punterthe NEOs were not increased in

2015. As required by2018 because the

renewal provisions of Mr. Sauer’s employment agreement, hisCommittee determined that their respective current base

salary increased from $450,000 to $475,000 on March 15, 2015. | | | | | | | | |

| | | Name | | 2014 Salary | | 2015 Salary | | Change |

| | | Jeremy J. Male | | $1,350,000 | | $1,350,000 | | 0% |

| | | Donald R. Shassian | | $650,000 | | $650,000 | | 0% |

| | | Clive Punter | | $550,000 | | $550,000 | | 0% |

| | | Andrew Sriubas | | $550,000 | | $550,000 | | 0% |

| | Richard H. Sauer | | $450,000 | | $475,000 | | 6% |

salaries were within the competitive market range.

|

| | | | | | |

| Name | | 2017 Salary | | 2018 Salary | | Change |

| Jeremy J. Male | | $1,350,000 | | $1,350,000 | | 0% |

| | | | | | | |

| Matthew Siegel | | — | | $650,000 | | 0% |

| | | | | | | |

| Andrew R. Sriubas | | $650,000 | | $650,000 | | 0% |

| | | | | | | |

| Clive Punter | | $620,000 | | $620,000 | | 0% |

| | | | | | | |

| Richard H. Sauer | | $575,000 | | $575,000 | | 0% |

| | | | | | | |

| Donald R. Shassian | | $650,000 | | $650,000 | | 0% |

Performance-Based Compensation—Executive Cash Bonus Plan

Ultimately, the goal of the plan is to reward behaviors that create value for our stockholders. More specifically, the

OUTFRONT Media Inc. Amended and Restated Executive Bonus Plan

(the “Amended and Restated Executive Bonus Plan”) is designed to motivate NEOs to:

| |

| ü | Manage and control costs |

| |

| ü | Achieve rigorous individual goals that are linked to our strategic plan |

These behaviors are measured through financial metrics, and, to a lesser extent, qualitative metrics as illustrated in the table below.

| | | | | | | | |

| | | Metric | | Weighting | | Payout Downside

(% of Target) | | Payout Upside

(% of Target) |

| | | Weighted Average Achievement of Adjusted OIBDA and AFFO | | 67% (75% Adjusted OIBDA, 25% AFFO) | | 50% | | 200% |

| | Individual Performance | | 33% | | |

|

| | | | | | |

| Metric | | Weighting | | Payout Downside (% of Target) | | Payout Upside (% of Target) |

| Financial Performance: Weighted Average Achievement of Adjusted OIBDA and AFFO | | 67% (75% Adjusted OIBDA, 25% AFFO) | | 50% | | 200% |

| | | | | |

| Individual Performance | | 33% | | |

|

| | |

The Company continues to use Adjusted OIBDA as a metric because it remains an important indicator of the Company’s operational strength and performance of our businesses, as it provides a link between profitability and operating cash flow. In 2015, the Committee approvedThe Company uses AFFO as the second metric (replacing free cash flow) because, like Adjusted OIBDA, management uses AFFO in managing the business and it is an important indicator of our operational strength and business performance. We believe the Adjusted OIBDA and AFFO metrics provide a more meaningful comparison of our Company’s operating performance to other companies in our industry as well as to REITs. | | Adjusted OIBDA and AFFO were selected and approved by the Committee as metrics for the Amended and Restated Executive Bonus Plan. These metrics are seen as critical to our long-term strategic plan, and are the most prominent two metrics tracked by our management and the investment community. |

The Committee has a process in place for setting goals and evaluating performance under the Amended and Restated Executive Bonus Plan. Based on the advice of our compensation consultant, the Committee chose to set the Amended and Restated Executive Bonus Plan thresholds, targets and maximums for fiscal year

20152018 using

analyst consensusbudgeted earnings estimates, which consider macroeconomic factors,

analyst estimates and

projected out-of-home advertising industry growth, as well as the Company’s financial and operational performance.

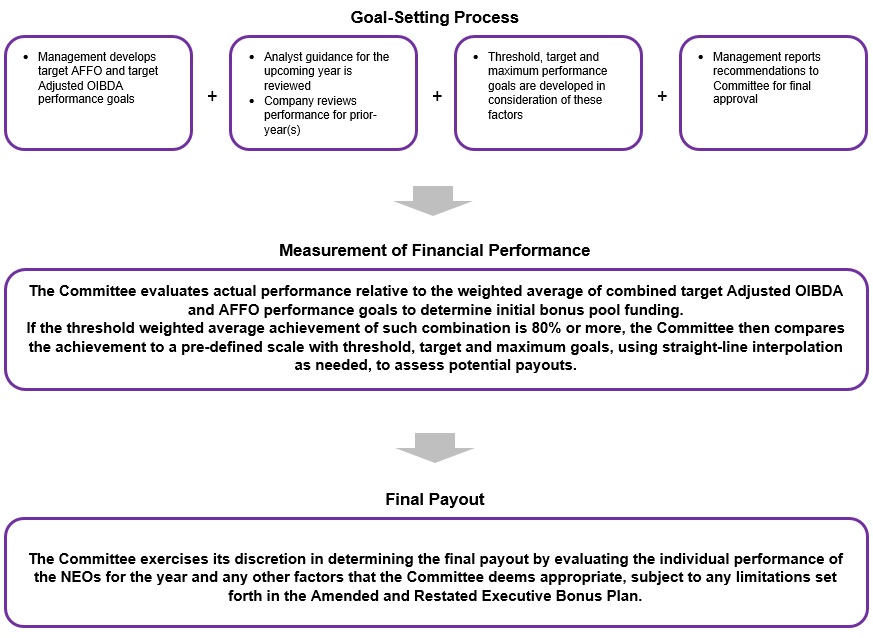

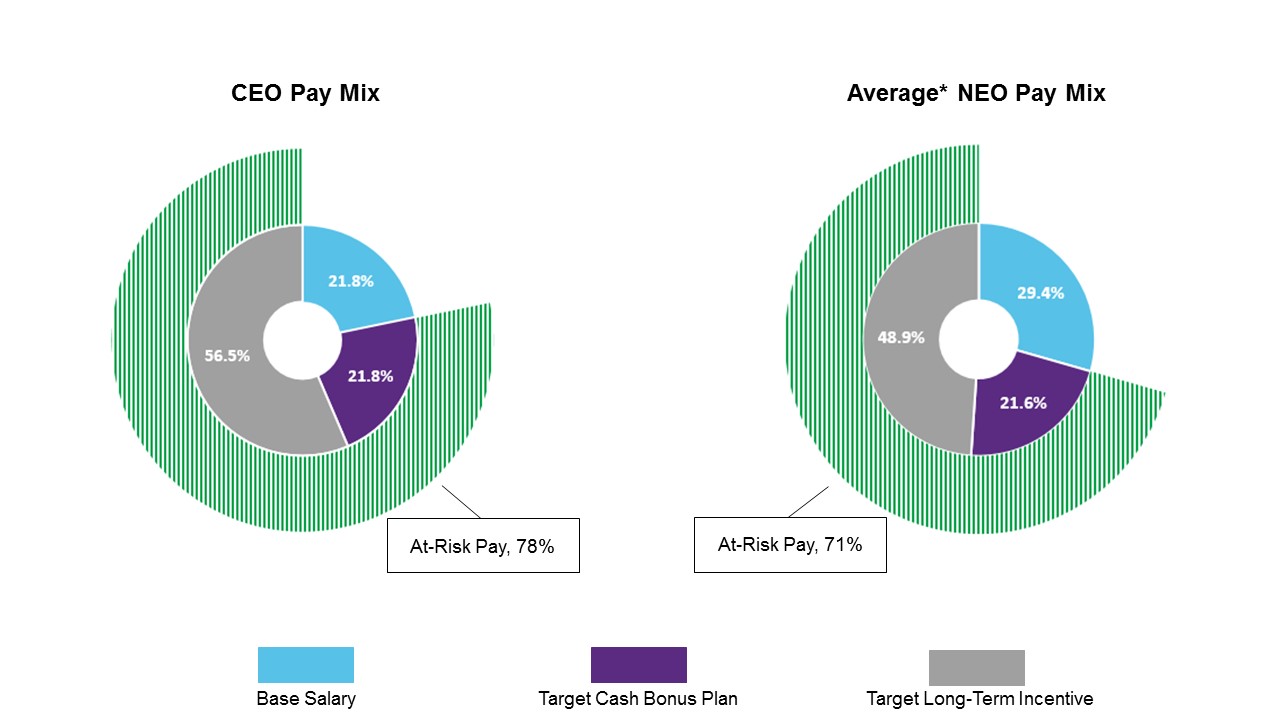

For purposes of Section 162(m) (before it was amended to, among other things, eliminate the performance-based compensation exception, effective as of January 1, 2018), the Committee useshad used a two-step approach to determine the amount of bonuses paid to NEOs based on a minimum funding threshold percentage equal to 50% of target Adjusted OIBDA and the Committee’s exercise of negative discretion. For 2018, in light of the amendments to Section 162(m), the Committee modified this approach. Beginning in 2018, in order for bonuses to be funded under the Amended and Restated Executive Bonus Plan, the Company must achieve an 80% or greater level of the weighted average achievement of a combination of the percentage of target Adjusted OIBDA achieved for calendar year 2018 and the percentage of target AFFO achieved for calendar year 2018, in each case, as adjusted in accordance with the Amended and Restated Executive Bonus Plan and the Omnibus SIP, as applicable, with such weighted average achievement calculated by allocating a 75% weighting to target Adjusted OIBDA and a 25% weighting to target AFFO (the “Minimum Funding Threshold”). If the Minimum Funding Threshold is achieved, the Committee compares the weighted average achievement of both financial metrics to a pre-defined bonus payout scale approved by the Committee in early 2018, with threshold, target and maximum goals, as set forth below. The Committee applies an increased payout of 25% for every 2.5% weighted average achievement above target, and a decreased payout of 12.5% for every 5% weighted average achievement below target. If the performance achievement results in a percentage between two performance levels on the scale, the bonus payout is interpolated. The Committee determines the actual bonus payments using the following percentages: 67% of the bonus payment is based on the Company’s financial performance, as described above, and 33% of the bonus payment is based on an evaluation of the individual performance of the NEOs. The first step is to fund the overall bonus pool, which occurs if the Company achieves pre-determined performance thresholds. The second step is for the Committee tomay exercise negative discretion to reflect Companyadjust any of the bonus payments, subject to any limitations set forth in the Amended and individual performance.Restated Executive Bonus Plan. This process is depicted in the flow-chartflowchart below.

Goal-Setting Process

| | | | | | | | | | | | |

• Management develops budgeted AFFO and Adjusted OIBDA performance goals

| | + | | • Analyst guidance for the upcoming year is reviewed

• Company reviews prior-year(s) performance

| | + | | • Threshold, target and maximum performance goals are developed in consideration of these factors

| | + | | • Management reports recommendation to Committee for final approval

|

Initial Funding

|

If threshold performance* is achieved, the bonus pool funds at the lesser of:

(a) 8x NEO base salaries and (b) $15 million

*Threshold = 50% of Budgeted Adjusted OIBDA

|

À

Measurement of Financial Performance

|

The Committee evaluates actual performance relative to Adjusted OIBDA and AFFO performance goals to determine payouts; and applies straight-line

interpolation for determining potential payouts for performance that falls

between threshold, target and maximum

|

À

Final Payout

|

The Committee exercises its negative discretion by considering the individual performance of the NEOs as well as major strategic initiatives that were achieved during the year

|

Determining the

20152018 Payout

The chart below summarizes the Committee’s review of

20152018 performance and the resulting Amended and Restated Executive Bonus Plan payouts.

| | | | |

| | Payout Funding

|

| | Threshold Performance

Achievedü

| | In 2015, Adjusted OIBDA achievement for cash bonus plan purposes was $442.8 million, which was $66.8 million above the threshold requirement of $376.0 million

|

| | | | |

| | Financial Performance

|

| | As noted previously, 67% of the NEOs’ annual cash bonus is based on the achievement of Adjusted OIBDA and AFFO. The table below depicts the (1) threshold, target and maximum performance requirements, (2) actual performance achievement for 2015 and (3) the resulting weighted average performance achievement for 2015.

|

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | 2015 Performance

Goal | | Weighting | | Actual | | Threshold | | Target | | Maximum | | Achievement | | |

| | | | Adjusted OIBDA* | | 75% | | $442.8 | | $376.0 | | $470.0 | | $517.0 | | 94.2% x 75% = 71% | | |

| | | | AFFO* | | 25% | | $272.0 | | $217.6 | | $272.0 | | $299.2 | | 100% x 25% = 25% | | |

| | | | 2015 Weighted Average Financial Achievement | | | | | | | | | | | | 96% of target | | |

| | | | 2015 Final Funding | | | | | | | | | | | | 89% of target | | |

| | | | | | | | | | | | | | | | | | |

|

* Dollars in millions. For purposes of calculating Adjusted OIBDA and AFFO actual, threshold, target and maximum performance amounts, the Adjusted OIBDA and AFFO metrics, which are defined and described in the section entitled “—Compensation Discussion and Analysis—Executive Summary—2015 Company Performance Highlights,” were further adjusted to exclude the impact of foreign currency exchange rates, which was approximately $5.0 million for 2015.

The financial weighted average achievement of Adjusted OIBDA and AFFO is 96%, which resulted in funding a bonus pool of 89%. This bonus outcome reflects the interpolated result from applying the weighted average achievement of both metrics against our pre-defined bonus payout scales.

|

| | |

| | Actual Individual Performance Results

|

| | Mr. Male reviewed and assessed the performance of each other NEO relative to the Company performance objectives outlined below, which were established earlier in the calendar year. Mr. Male then discussed his assessment of each NEO’s performance with the Committee. The Committee also formally assessed Mr. Male’s performance against his pre-established individual objectives as part of this process. The Committee then met in executive session to consider Mr. Male’s recommendations and to make final payout determinations.

|

| | The Company performance objectives in 2015 were as follows:

|

| | ü Strategic acquisitions

ü The successful execution of the divestiture of our outdoor advertising business in Latin America

ü Static billboard to digital conversions

ü Technology enhancements of our business, assets and products

ü Certain personnel priorities, including the integration related to our acquisition of certain outdoor advertising businesses of Van Wagner Communications, LLC, the reorganization of our salesforce, and the re-alignment of sales regions

After reviewing Mr. Male’s recommendations, the Committee determined that, for the 33% portion of each NEO’s annual bonus that is based on individual performance, the funding would be set at the same funding level as the financial performance component of 89%.

|

| | |

| | 2015 Final Payouts

|

| | The actual performance bonus paid to each NEO under the Amended and Restated Executive Bonus Plan

for 2015 are as follows:

|

| | | | | | | | | | | | | | |

| | | | | |

| | | | | | | Target Bonus Opportunity | | Actual Bonus Earned | | |

| | | | | NEO | | As a % of Base

Salary | | ($) | | As % of Target

Bonus

Opportunity | | ($) | | |

| | | | Jeremy J. Male* | | 100% | | $1,349,999 | | 89% | | $1,201,500 | | |

| | | | Donald R. Shassian | | 75% | | $487,500 | | 89% | | $433,875 | | |

| | | | Clive Punter | | 75% | | $412,500 | | 89% | | $367,125 | | |

| | | | Andrew Sriubas | | 75% | | $412,500 | | 89% | | $367,125 | | |

| | | | Richard H. Sauer | | 50% | | $237,500 | | 89% | | $211,375 | | |

* In 2015, the Committee, in its discretion, increased Mr. Male’s annual target bonus opportunity from 85% to 100% of his annual salary in effect on November 1st of the calendar year to which the annual bonus relates. See “—Compensation Discussion and Analysis—Employment Agreements.” |

|

| | | | | | | |

| Payout Funding |

Threshold Performance Achieved ü | In 2018, the Minimum Funding Threshold goal was achieved. Actual Adjusted OIBDA for cash bonus plan purposes was $479.5 million and actual AFFO was $299.7 million, each of which were greater than 80% of the corresponding threshold amounts of $377.6 million and $236 million, respectively. |

| Financial Performance |

| As noted previously, 67% of the NEOs’ annual cash bonus payout is based on the weighted average achievement of target Adjusted OIBDA and target AFFO, 75% and 25%, respectively. The table below depicts the (1) threshold, target and maximum performance goals used to determine bonus pool funding, (2) actual performance achievement for 2018 for these goals, and (3) the resulting weighted average performance achievement for 2018 for financial performance. |

| 2018 Performance Goal | Weighting | Actual | Threshold | Target | Maximum | Achievement |

| Adjusted OIBDA* | 75% | $479.5 | $377.6 | $472.0 | $519.2 | 101.6% x 75% = 76.2% |

| AFFO* | 25% | $299.7 | $236.0 | $295.0 | 324.5

| 101.6% x 25% = 25.4% |

| 2018 Weighted Average Financial Achievement | | 101.6% of target |

| 2018 Final Funding | | 116% of target |

| | | | | | | | |

| * Dollars in millions. For purposes of calculating Adjusted OIBDA and AFFO actual, threshold, target and maximum performance amounts, the Adjusted OIBDA and AFFO metrics, which are defined and described in the section entitled “—Compensation Discussion and Analysis—Executive Summary—2018 Company Performance Highlights,” may be further adjusted to account for specified items, however, no further adjustments were made for 2018. |

| For 2018, the financial weighted average achievement of target Adjusted OIBDA and target AFFO was 101.6%, which resulted in funding a bonus pool for our NEO’s. The Committee applied the weighted average achievement of both metrics against the pre-defined bonus payout scale approved by the Committee in early 2018, as described above. Since the financial weighted average achievement for 2018 was at 101.6%, applying interpolation, the bonus payout was funded at 116%. |

| Actual Performance Results |

| In early 2019, Mr. Male reviewed and assessed the performance of each other NEO relative to the Company performance objectives outlined below, which were established in early 2018. Mr. Male then discussed his assessment of each NEO’s performance with the Committee. The Committee also formally assessed Mr. Male’s performance against his pre-established individual objectives as part of this process. The Committee then met in executive session to consider Mr. Male’s recommendations and to make final payout determinations. The NEO and Company performance objectives in 2018 were as follows: |

| ü | Manage and deploy digital equipment in connection with the Company’s transit franchise agreement with the MTA |

| ü | Implement strategic sales and real estate initiatives |

| ü | Static billboard to digital conversions and deployment of new digital displays |

| ü | Technology enhancements of our business, assets and products |

| ü | Establish diversity and inclusion program |

| ü | Renew 18 labor union agreements expiring in 2018 |

| | | | | | | | |

| After reviewing Mr. Male’s recommendations, the Committee determined that for the 33% individual performance component of each NEO’s annual bonus, the funding would be set at the same funding level as the 101.6% financial performance component because the Committee believes that the NEOs equally collaborate on the Company’s performance objectives, and their respective individual performances are tied to the Company’s financial performance. |

|

| | | | | | | |

| 2018 Final Payouts |

| | | Target Bonus Opportunity | Actual Bonus Paid |

| NEO | As a % of Base Salary | ($) | As a % of Target Bonus Opportunity | ($) |

| Jeremy J. Male | 100% | 1,350,000 | 116% | 1,566,000 |

| Matthew Siegel* | 75% | 281,815 | 116% | 326,905 |

| Andrew Sriubas | 85% | 552,500 | 116% | 640,900 |

| Clive Punter | 75% | 465,000 | 116% | 539,400 |

| Richard H. Sauer | 65% | 373,750 | 116% | 433,550 |

| Donald R. Shassian* | 85% | 552,500 | — | — |

| | | | | | | | |

| * In 2018, Mr. Siegel’s target bonus was pro-rated based on his June 4, 2018 hire date. In connection with Mr. Shassian’s retirement from the Company effective as of June 1, 2018, and the execution of the Release (as defined below), Mr. Shassian received, among other things, a lump-sum cash payment of $230,208.33, representing the pro-rata portion of his 2018 target bonus prior to year-end. See “—Employment Agreements.” |

Performance-Based Compensation—Long-Term Equity Incentive Compensation

The Company provides long-term equity incentive compensation to the NEOs that is intended to:

| |

| ü | | Balance (1) stockholder alignment, (2) line-of-sight to critical financial metrics and (3) long-term retention |

| |

| ü | | Reflect typical market practice of our peer group and similarly-sized general industry companies |

| |

| ü | | Align with our stated pay-for-performance compensation philosophy |

The Company’s long-term equity incentive compensation is comprised of two separate components:

| | | | |

| | | |

| Type of Long-Term Equity Incentive Compensation | Weighting | Overview | | Rationale |

| | Type of Long-

Term Equity

Incentive

Compensation

| | Weighting | | Overview | | Rationale |

| | | | |

| | PRSUs | | 60% | | ü Must be earned Earned based on one-year Adjusted OIBDA and AFFO performance weighted 75% and 25%, respectively | | ü Based on financial metrics that are (1) directly linked to stock price growth, (2) market-competitive, and (3) well understood by management |

| | | | | ü Any earned RSUsPRSUs are also subject to additional ratable vesting over a three-year period following the year of grant date | | ü Provides alignment with stockholders |

| | | | ü Fosters retention

|

| | TRSUs | | 40% | | ü Vests ratably over a three-year period following the year of grant date

| | ü Fosters retention

|

| | | | | | ü Provides alignment with stockholders

|

ü Fosters retention |

Similar to 2014, on

On February

18, 2015,22, 2018, the Company made a grant of PRSUs to its NEOs.

TheGrants of PRSUs follow the same process as that of awards under the Amended and Restated Executive Bonus Plan in that the grants of PRSUs are

at-risk and subject to

pre-established levelsthe Minimum Funding Threshold. If the Minimum Funding Threshold is achieved, the Committee compares the weighted average achievement of

AFFOboth financial metrics to the performance and

Adjusted OBIDA that werepayout schedule approved by the

Committee.Committee in early 2018, with threshold, target and maximum goals, as set forth below. The

Committee applies an increased payout of 25% for every 2.5% weighted average achievement above target, and a decreased payout of 12.5% for every 5% weighted average achievement below target. If the performance achievement results in a percentage between two performance levels on the scale, the grant payout is interpolated. The Committee may exercise discretion to adjust any of the grants of PRSUs,

are fully at risk,subject to any limitations set forth in

that they are not earned unless the

Company achieves performance of at least 80% relative to both metrics. The table below illustrates the pay and performance schedule applicable to the 2015 grant of PRSUs. The Company applies a straight-line interpolation methodology for performance between 80% and 120% of target. | | | | | | |

| | | | |

| | | Performance and Payout

Schedule | | Level of Performance (Relative to Target Performance) | | Level of Payout (Relative to Target # of PRSUs Granted) |

| | | Below Threshold | | < 80% | | 0% |

| | | Threshold | | 80% | | 60% |

| | | Target | | 100% | | 100% |

| | | Maximum | | 110% | | 120% |

Omnibus SIP.

|

| | |

Performance and Payout Schedule | Level of Performance (Relative to Target Performance) | Level of Payout (Relative to Target # of PRSUs Granted) |

| Below Threshold | <80% | 0% |

| Threshold | 80% | 60% |

| Target | 100% | 100% |

| Maximum | ≥110% | 120% |

The Committee considered a number of factors when establishing each NEO’s

20152018 total grant value:

| |

| ü | Recommendations from the Chief Executive Officer (excluding for his own role) based on the Company performance objectives described above |

| ü | Extraordinary work relating to the Separation (as defined below), our REIT conversion and our acquisition of certain outdoor advertising businesses of Van Wagner Communications, LLC |

| ü | Market data and consultation provided by ClearBridge |

| |

| ü | Existing contractual obligations through employment agreements |

| |

| ü | Potential levels of dilution |

| |

| ü | Internal equity amongst the NEO group |

| |

| ü | The desire to shift to place more emphasis on long-term incentives from a pay mix perspective |

The table below provides the total

20152018 grant-date value and the number of target PRSUs and TRSUs that were granted to each NEO.

| | | | | | | | | | | | | | |

| | | | |

| | | NEO | | Total 2015 Grant

Value | | | Number of Units Granted in 2015 | |

| | | | Target PRSUs | | | TRSUs | |

| | | Jeremy J. Male* | | | $3,750,000 | | | | 75,503 | | | | 50,335 | |

| | | Donald R. Shassian* | | | $2,000,000 | | | | 40,268 | | | | 26,845 | |

| | | Clive Punter | | | $750,000 | | | | 15,100 | | | | 10,067 | |

| | | Andrew Sriubas | | | $750,000 | | | | 15,100 | | | | 10,067 | |

| | | Richard H. Sauer* | | | $570,000 | | | | 11,476 | | | | 7,651 | |

|

| | | |

| | Total 2018 | Number of Units Granted in 2018 |

| NEO | Grant Value | Target PRSUs | TRSUs |

| Jeremy J. Male | $3,500,000 | 97,583 | 65,055 |

| Matthew Siegel* | $300,000 | — | 15,045 |

| Andrew R. Sriubas | $2,000,000 | 55,762 | 37,174 |

| Clive Punter | $825,000 | 23,001 | 15,334 |

| Richard H. Sauer | $600,000 | 16,728 | 11,152 |

| Donald R. Shassian* | $2,300,000 | 64,126 | 42,750 |

| |

| * | In 2015,2018, the Committee in its discretion, increased the targetawarded a one-time grant of TRSUs to Mr. Siegel, with a value of Messrs. Male and Shassian’s long-term equity incentive compensation value and, as required by the renewal provisions of$300,000, in connection with entering into his employment agreement,agreement. In connection with Mr. Shassian’s retirement from the target valueCompany effective as of June 1, 2018, and the execution of the Release, Mr. Sauer’s long-term equity incentive compensation increased.Shassian received, among other things, accelerated vesting of 23,198 TRSUs and 30,502 PRSUs previously granted to him, but forfeited his 2018 PRSU and TRSU grants. See “—Employment Agreements,” “—2018 Summary Compensation DiscussionTable” and Analysis—Employment Agreements.” In addition, based on the factors considered by the Committee, as described above, the Committee,“—Potential Payments Upon Termination or Change in its discretion, increased Messrs. Male, Shassian and Sauer’s grant values above their target amounts.Control.” |

In February

2016,2019, the Committee determined the requisite threshold level of AFFO and Adjusted OIBDA performance was attained (as described above for the Amended and Restated Executive Bonus Plan for

2015)2018) and, accordingly, the number of PRSUs actually earned based on our performance relative to the performance goals established by the Committee for the

20152018 calendar year.

The number of shares earned upon vesting of the PRSUs is determined in accordance with the performance and payout schedule described in the table above. For 2015,2018, we achieved 96%101.6% of the target weighted average achievement of a combination of target Adjusted OIBDA and target AFFO, which resulted in final PRSUs eligible to vest in 20152018 at 91%103% of target PRSUs. This outcome reflects the interpolated result from applying the weighted average achievement of both metrics against our pre-defined equity payout scales. The table below sets forth the number of PRSUs earned in 20152018 and eligible to vest in accordance with the time-based vesting schedule described below.

| | | | | | | | | | | | |

| | | | |

| | | NEO | | Target Number of PRSUs Granted in 2015 | | Actual Number of PRSUs Earned Based on 2015 Performance |

| | | Jeremy J. Male | | | | 75,503 | | | | | 68,708 | |

| | | Donald R. Shassian | | | | 40,268 | | | | | 36,645 | |

| | | Clive Punter | | | | 15,100 | | | | | 13,743 | |

| | | Andrew Sriubas | | | | 15,100 | | | | | 13,743 | |

| | | Richard H. Sauer | | | | 11,476 | | | | | 10,444 | |

|

| | |

| NEO | Target Number of PRSUs in 2018 | Actual Number of PRSUs Earned Based on 2018 Performance |

| Jeremy J. Male | 97,583 | 100,511 |

| Matthew Siegel* | — | — |

| Andrew R. Sriubas | 55,762 | 57,436 |

| Clive Punter | 23,001 | 23,694 |

| Richard H. Sauer | 16,728 | 17,232 |

| Donald R. Shassian* | 64,126 | — |

| |

| * | Mr. Siegel joined the Company on June 4, 2018, after the 2018 PRSUs were granted. In connection with Mr. Shassian’s retirement from the Company effective as of June 1, 2018, and the execution of the Release, Mr. Shassian received, among other things, accelerated vesting of 23,198 TRSUs and 30,502 PRSUs previously granted to him, but forfeited his 2018 PRSU and TRSU grants. See “—Employment Agreements,” “—2018 Summary Compensation Table” and “—Potential Payments Upon Termination or Change in Control.” |

The TRSUs and the earned PRSUs generally vest in equal installments on each of February

19, 2016, 2017,22, 2019, 2020, and

20182021 subject to each NEO’s respective continued employment through the applicable vesting date and the terms of his employment agreement and/or equity award. If we pay regular cash dividends with respect to our common stock, the holders of TRSUs and PRSUs will be eligible for dividend equivalent payments in shares of our common stock when and to the extent that the related TRSUs or PRSUs vest and are settled.

In 2015, the Board also granted TRSUs pursuant to the Company’s Fund-the-Future program (the “Fund-the-Future program”) to a broad group of our employees, including our NEOs. The primary purpose of the Fund-the-Future program was to provide additional income to employees who do not otherwise receive targeted long-term equity incentive compensation for Company performance. For 2015, the Board decided to award a number of TRSUs to all participants in the program based on the employee’s annual base pay (capped at $500,000) or benefit base pay, on February 19, 2015 (the date of grant), multiplied by 2.5% and then divided by our common stock price of $29.83 on the date of grant.

Pursuant to the Fund-the-Future program, the Board granted the following NEO’s TRSUs:

| | | | |

| | |

| | NEO

| | Number of

TRSUs

|

| | Jeremy J. Male

| | 419 |

| | Donald R. Shassian

| | 419 |

| | Clive Punter

| | 419 |

| | Andrew Sriubas

| | 419 |

| | Richard H. Sauer

| | 377 |

These Fund-the-Future TRSUs generally vest in equal installments on each of the first three anniversaries of February 19, 2015, subject to the NEO’s continued employment through the applicable vesting date and the terms of his employment agreement and/or equity award. If we pay regular cash dividends on our common stock, the holders of these TRSUs will be eligible for cash dividend equivalents payments at the time and to the extent that the related TRSUs vest and are settled.

Retirement and Deferred Compensation Plans

The Company maintains a broad-based tax-qualified defined contribution plan (the “401(k) Plan”) and a nonqualified deferred compensation plan (the “Excess 401(k) Plan”), effective as of January 1, 2014. During

2015,2018, we provided participating NEOs with matching contributions in the 401(k) Plan and the Excess 401(k) Plan as we believe this benefit is reasonable and market-competitive.

Information regarding the participation by our NEOs in the Excess 401(k) Plan is set forth in the

20152018 Nonqualified Deferred Compensation table and the narratives following this table. The Excess 401(k) Plan provides our senior executives with the opportunity to save for retirement beyond the qualified plan limitations.

Other Compensation (Other Personal Benefits)

Pursuant to Messrs. Male and Punter’s employment agreements, they were each eligible to receive certain contractual housing and travel benefits during the first year of their respective agreements. The Company paid suitable housing expenses for Mr. Male and his family for a period of twelve months following the effective date of the employment agreement, and trips to visit family in the United Kingdom during the same period of time. The Committee approved for Mr. Male’s housing costs and trip costs to be continued through December 31, 2015. The Company paid reasonable and customary expenses associated with Mr. Punter’s planned relocation to the New York metropolitan area, including one trip to New York, suitable housing for him and his family for a period of twelve months following the effective date of the employment agreement, and up to $40,000 annually of reimbursable travel expenses to and from the United Kingdom to visit family. The Committee approved for Mr. Punter’s housing costs to be continued from the one-year anniversary of his date of hire through December 31, 2015. To the extent any of these payments made to Messrs. Male and Punter are taxable, the Company will make an additional payment to them in an amount that, after payment of all taxes payable by them with respect to the additional payment, will equal the amount of all taxes payable by them with respect to the related reimbursement. Other than as described above for Messrs. Male and Punter, our NEOs do not receive any other perquisites or personal benefits. See “Compensation Discussion and Analysis—Employment Agreements” and “—2015 Summary Compensation Table.”

Stock Ownership Guidelines

To better align the interests of our executive team with those of our stockholders, we

formallyhave adopted stock ownership guidelines for

our executive

officers in October 2015.officers. Ownership in the Company is evidence of the confidence our executives have in the Company’s long-term performance.

| |

| ü | Chief Executive Officer: 5x base salary |

| |

| ü | Chief Financial Officer: 3x base salary |

| |

| ü | Other executive officers: 2x base salary |

Shares considered “owned” for purposes of complying with the stock ownership guidelines are:

| |

| ü | Shares of stock owned individually or jointly, or in trusts owned by the executive |

| |

| ü | PRSUs once performance level and number of PRSUs earned have been determined |

Each executive officer has five years from the time he becomes subject to the ownership guidelines to meet the guideline. Once the executive’s qualified holdings reach the guideline, the executive will be deemed to have met the guideline going forward. The executive will need to maintain a level of ownership in either the number of

shares held when the guideline was met (to mitigate the need to increase the number of shares owned when there is a reduction in the share price) or the current dollar guideline (to have the ability to reduce the number of shares when the share price increases). Management will present a progress report annually to the Committee regarding ownership levels.

As

With the exception of Mr. Siegel, who joined the Company in June 2018, as of or prior to December 31, 2015, Messrs. Male and Shassian had2018, all of the NEOs have met their respective ownership guidelines. The other NEOs are expected

Clawback Policy

In 2017, the Board voluntarily adopted a recoupment or “clawback” policy. In the event the Company is required to

meetprepare an accounting restatement due to the

stock ownership guidelinesCompany’s material noncompliance with any financial reporting requirement under the securities laws to correct a material error, and the Board determines that an officer (as defined under SEC Rule 16a-1(f)) has willfully committed an act of fraud or dishonesty in

2016.the performance of his or her duties that contributed to the material noncompliance that resulted in the Company’s obligation to prepare the accounting restatement, then the Board will direct the Company to recoup from the culpable officer all excess incentive compensation received during the reporting period or periods impacted by the accounting restatement.

Compensation Deductibility Policy

Section 162(m) of the Code generally limits to $1 million the federal tax deductibility of compensation paid in one year to

the Chief Executive Officer and the three most highly compensatedcertain of our executive officers

(other than the Chief Financial Officer) employed by us at the end of the year. Compensation(and, beginning in 2018, certain former executive officers). Historically, compensation that

satisfiessatisfied the Code’s requirements for “performance-based compensation”

iswas not subject to this deduction limitation.

This performance-based exception has now been repealed, effective for taxable years beginning after December 31, 2017, except for certain compensation arrangements in place as of November 2, 2017 for which transition relief is available. Our Committee considers deductibility as just one factor in determining the form and terms of compensation we provide. In certain circumstances, the Committee may

decide to granthave granted compensation that will not qualify as “performance-based” for purposes of Section 162(m)

, as in effect prior to 2018, including when, in the Committee’s judgment, certain compensation

iswas needed to achieve the Committee’s overall compensation objectives.

We

continue to evaluate the impact of the recent revisions to Section 162(m), but regardless of that impact we reserve the right to

awardprovide compensation that

doesmay not

qualify as “performance-based”be deductible for

purposes of Section 162(m), including under the Amended and Restated Executive Bonus Plan and the Amended and Restated Omnibus SIP.federal income tax purposes. Moreover, even if the Committee

intendsintended to grant compensation that

qualifiesmight qualify as “performance-based” for purposes of Section 162(m), we cannot guarantee that such compensation will so qualify or ultimately will be deductible.

Compensation Risk Assessment

In

2015,2018, as part of the Company’s enterprise risk management process, our

Executive Vice President and Chief Financial Officer,

Executive Vice President, Chief Human Resources Officer,

Executive Vice President, General Counsel,

and Secretary, Vice President, Internal Audit,

Senior Vice President, Controller,

Vice President, Assistant General CounselCorporate Secretary and

the Senior Director

of Compensation evaluated our compensation programs for potential areas of risk. During this initial risk assessment, we reviewed our compensation and benefit programs to identify potential risks and risk mitigation factors. On the basis of this initial assessment, management concluded that the Company’s compensation programs are structured in a way that does not create risks that are reasonably likely to have a material adverse effect on the Company. The Committee reviewed the results of this assessment at the end of

20152018 and agreed with management’s conclusion.

COMPENSATION COMMITTEE REPORT

The following Compensation Committee Report does not constitute “soliciting material” and shall not be deemed “filed” or incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”) or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), except to the extent OUTFRONT Media Inc., a Maryland corporation (the “Company”), specifically requests that the information be treated as soliciting material or specifically incorporates such information by reference into a document filed under the Securities Act or the Exchange Act.

The Compensation Committee (the “Compensation Committee”) of the Board of Directors (the “Board”) of the Company has reviewed and discussed with the Company’s management the Compensation Discussion and Analysis (“CD&A”) included in the Company’s proxy statement for the

20162019 Annual Meeting of Stockholders (the “Proxy Statement”). Based on that review and discussion, the Compensation Committee has recommended to the Board that the CD&A be included in the Proxy Statement and incorporated by reference from the Proxy Statement into the Company’s Annual Report on Form 10-K for the year ended December 31,

2015,2018, which was filed with the Securities and Exchange Commission on February

29, 2016.27, 2019.

Members of the Compensation Committee

Peter Mathes, Chair

William ApfelbaumAngela Courtin

2015

2018 Summary Compensation Table

The following table presents summary information regarding the

total compensation awarded to, earned by, or paid to each of the NEOs for services rendered to us for the years ended December 31,

2015, 20142018, 2017 and

2013,2016, as applicable.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal

Position (a)(1) | | Year

(b) | | | Salary

($)(c)(2) | | | Bonus

($)(d) | | | Stock

Awards

($)(e)(3) | | | Option

Awards

($)(f) | | | Non-Equity

Incentive Plan

Compensation

($)(g)(2)(4) | | | Change in

Pension

Value and

Non-qualified

Deferred

Compensation

Earnings

($)(h) | | | All Other

Compensation

($)(i)(5) | | | Total

($)(j) | |

| Jeremy J. Male | | | 2015 | | | | 1,349,999 | | | | — | | | | 3,766,246 | | | | — | | | | 1,201,500 | | | | — | | | | 428,044 | | | | 6,745,789 | |

Chairman and | | | 2014 | | | | 1,349,999 | | | | — | | | | 3,968,238 | | | | — | | | | 1,377,000 | | | | — | | | | 683,985 | | | | 7,379,222 | |

Chief Executive Officer | | | 2013 | | | | 389,423 | | | | 1,279,000 | | | | 2,199,910 | | | | 799,997 | | | | — | | | | — | | | | 4,077 | | | | 4,672,407 | |

| Donald R. Shassian | | | 2015 | | | | 650,000 | | | | — | | | | 2,014,480 | | | | — | | | | 433,875 | | | | — | | | | 6,382 | | | | 3,104,737 | |

Executive Vice | | | 2014 | | | | 650,000 | | | | — | | | | 2,496,215 | | | | — | | | | 585,000 | | | | — | | | | 102,909 | | | | 3,834,124 | |

President, Chief Financial Officer | | | 2013 | | | | 67,500 | | | | — | | | | 499,974 | | | | — | | | | — | | | | — | | | | 168 | | | | 567,642 | |

Clive Punter Executive Vice President, Chief Revenue Officer | | | 2015 | | | | 550,000 | | | | — | | | | 763,230 | | | | — | | | | 367,125 | | | | — | | | | 180,467 | | | | 1,860,823 | |

| Andrew R. Sriubas | | | 2015 | | | | 550,000 | | | | — | | | | 763,230 | | | | — | | | | 367,125 | | | | — | | | | 9,555 | | | | 1,689,911 | |

Executive Vice President, Strategic Planning & Development | | | 2014 | | | | 232,692 | | | | 177,432 | | | | 749,958 | | | | — | | | | — | | | | — | | | | 25,323 | | | | 1,185,405 | |

| Richard H. Sauer | | | 2015 | | | | 470,673 | | | | — | | | | 581,804 | | | | — | | | | 211,375 | | | | — | | | | 9,754 | | | | 1,273,606 | |

Executive Vice | | | 2014 | | | | 442,710 | | | | — | | | | 310,953 | | | | — | | | | 270,000 | | | | — | | | | 29,225 | | | | 1,052,888 | |

President, General Counsel and Secretary | | | 2013 | | | | 397,375 | | | | — | | | | 109,868 | | | | — | | | | 197,926 | | | | — | | | | 9,538 | | | | 714,707 | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position(a) | | Year (b) | | Salary ($)(c)(1) | | Bonus ($)(d) | | Stock Awards ($)(e)(2) | | Option Awards ($)(f) | | Non-Equity Incentive Plan Compensation ($)(g)(1)(3) | | Change in Pension Value and Non-qualified Deferred Compens-ation Earnings ($)(h) | | All Other Compensation ($)(i)(4) | | Total ($)(j) |

| Jeremy J. Male | | 2018 | | 1,349,999 |

| | — |

| | 3,499,970 |

| | — |

| | 1,566,000 |

| | — |

| | 1,260 |

| | 6,417,229 |

|

| Chairman and Chief Executive Officer | | 2017 | | 1,349,999 |

| | — |

| | 2,999,970 |

| | — |

| | 1,053,000 |

| | — |

| | 1,260 |

| | 5,404,229 |

|

| | 2016 | | 1,349,999 |

| | — |

| | 2,299,987 |

| | — |

| | 1,228,500 |

| | — |

| | 1,260 |

| | 5,579,746 |

|

| Matthew Siegel | | 2018 | | 362,500 |

| | — |

| | 299,997 |

| | — |

| | 326,905 |

| | — |

| | 12,194 |

| | 1,001,596 |

|

Executive Vice President, Chief Financial Officer(5) | | 2017 | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| | 2016 | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Andrew Sriubas | | 2018 | | 650,000 |

| | — |

| | 1,999,983 |

| | — |

| | 640,900 |

| | — |

| | 10,444 |

| | 3,301,327 |

|

| Chief Commercial Officer | | 2017 | | 590,769 |

| | — |

| | 1,399,979 |

| | — |

| | 368,721 |

| | — |

| | 10,143 |

| | 2,369,612 |

|

| | | 2016 | | 550,000 |

| | — |

| | 749,983 |

| | — |

| | 375,375 |

| | — |

| | 9,969 |

| | 1,685,327 |

|

| Clive Punter | | 2018 | | 620,000 |

| | — |

| | 824,969 |

| | — |

| | 539,400 |

| | — |

| | 10,318 |

| | 1,994,687 |

|

| Executive Vice President, Chief Revenue Officer | | 2017 | | 565,077 |

| | — |

| | 749,986 |

| | — |

| | 331,511 |

| | — |

| | 73,999 |

| | 1,720,572 |

|

| | 2016 | | 550,000 |

| | — |

| | 749,983 |

| | — |

| | 375,375 |

| | — |

| | 80,970 |

| | 1,756,327 |

|

| Richard H. Sauer | | 2018 | | 575,000 |

| | — |

| | 599,978 |

| | — |

| | 433,550 |

| | — |

| | 10,350 |

| | 1,618,878 |

|

| Executive Vice President, General Counsel | | 2017 | | 561,442 |

| | — |

| | 599,978 |

| | — |

| | 282,226 |

| | — |

| | 10,080 |

| | 1,453,726 |

|

| | 2016 | | 493,365 |

| | — |

| | 599,975 |

| | — |

| | 273,000 |

| | — |

| | 9,855 |

| | 1,376,195 |

|

| Donald R. Shassian | | 2018 | | 287,500 |

| | — |

| | 2,299,972 |

| | — |

| | — |

| | — |

| | 256,902 |

| | 2,844,374 |

|

Former Executive Vice President, Chief Financial Officer(5) | | 2017 | | 650,000 |

| | — |

| | 2,299,978 |

| | — |

| | 430,950 |

| | — |

| | 10,269 |

| | 3,391,197 |

|

| | 2016 | | 650,000 |

| | — |

| | 1,699,969 |

| | — |

| | 443,625 |

| | — |

| | 10,094 |

| | 2,803,688 |

|

(1) |

| Mr. Punter was appointed as an executive officer of the Company in 2014 and first became an NEO for 2015. | | | |

| | | | |

(2) | |

| (1) | Salary and Non-Equity Incentive Plan Compensation for 20152018 include amounts deferred under qualified and nonqualified arrangements. |

(3) | |

| (2) | For stock awards made in 2015,2018, these amounts reflect the aggregate grant date fair values of grants under the Amended and Restated Omnibus SIP, determined in accordance with FASB ASC Topic 718,Compensation—Compensation—Stock Compensation. For the PRSUs granted in 20152018 to Messrs. Male, Sriubas, Punter, Sauer and Shassian Sauer, Sriubas(representing $2,099,986, $1,199,998, $494,982, $359,987 and Punter (representing $2,252,254, $1,201,194, $342,329, $450,433 and $450,433,$1,379,992, respectively, of the aggregate grant date values included in column (e)), the maximum grant date value, determined in accordance with FASB ASC Topic 718, would be $2,702,717, $1,441,445, $410,789, $540,520$2,519,983, $1,439,998, $593,978, $431,984 and $540,520,$1,665,990, respectively. The assumptions upon which these amounts are based are set forth in note 1314 to our consolidated financial statements contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015.2018. In connection with Mr. Shassian’s retirement from the Company effective as of June 1, 2018, and the execution of the Release, Mr. Shassian received, among other things, accelerated vesting of 30,502 PRSUs previously granted to him, but forfeited his 2018 PRSU grants.See “—Employment Agreements” and “—Potential Payments Upon Termination or Change in Control.” |

(4) | |

| (3) | Amounts represent the annual bonus earned for 20152018 under the Amended and Restated Executive Bonus Plan. See “—Compensation Discussion and Analysis—Elements of 20152018 NEO Compensation—Performance-based Compensation-ExecutiveCompensation—Executive Cash Bonus Plan.” |

(5) | |

| (4) | The following table and footnotes describe each component of the “All Other Compensation” column for 2015:2018: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Named Executive Officer | | Company

Contribution

to 401(k)

Plan ($) | | | Company

Contribution to

401(k) Excess

Plan/Deferred

Compensation

Arrangement

($) | | | Company-Paid

Life Insurance

($) | | | Housing,

Relocation and

Travel

Reimbursement

($)(a) | | | Tax

Reimbursement

($)(b) | | | Severance

Payments/

Benefits

($) | | | Total

($) | |

Jeremy J. Male | | | — | | | | — | | | | 1,008 | | | | 207,879 | | | | 219,157 | | | | — | | | | 428,044 | |

Donald R. Shassian | | | 5,727 | | | | — | | | | 655 | | | | — | | | | — | | | | — | | | | 6,382 | |

Clive Punter | | | 9,275 | | | | — | | | | 555 | | | | 100,300 | | | | 70,337 | | | | — | | | | 180,467 | |

Andrew R. Sriubas | | | 9,000 | | | | — | | | | 555 | | | | — | | | | — | | | | — | | | | 9,555 | |

Richard H. Sauer | | | 9,275 | | | | — | | | | 479 | | | | — | | | | — | | | | — | | | | 9,754 | |

|

| | | | | | | | | | | | |

| Named Executive Officer | | Company Contribution to 401(k) Plan ($) | | Company Contribution to 401(k) Excess Plan/Deferred Compensation Arrangement ($) | | Company-Paid Life Insurance ($) | | Tax Reimbursement ($) | | Severance Payments/Benefits ($)(a) | | Total ($) |

| Jeremy J. Male | | — | | — | | 1260 | | — | | — | | 1,260 |

| Matthew Siegel | | 9,625 | | 1,750 | | 819 | | — | | — | | 12,194 |

| Andrew Sriubas | | 9,625 | | — | | 819 | | — | | — | | 10,444 |

| Clive Punter | | 9,625 | | — | | 693 | | — | | — | | 10,318 |

| Richard H. Sauer | | 9,625 | | — | | 725 | | — | | — | | 10,350 |

| Donald R. Shassian | | 9,625 | | — | | 819 | | — | | 246,458 | | 256,902 |

| |

| (a) | For Messrs. MaleMr. Shassian, the amount shown includes the lump-sum cash payment, representing the pro-rata portion of his 2018 target bonus prior to year-end and Punter,payments for accrued vacation time, in connection with Mr. Shassian’s retirement from the amounts shown reflect housing, relocation and travel allowance pursuant to their respective employment agreements.Company effective as |

of June 1, 2018, and the execution the Release. See “—Employment Agreements,” and “—Potential Payments Upon Termination or Change in Control.”

| (b) |

| (5) | For Messrs. Male and Punter,Mr. Shassian, the amounts shown reflect tax reimbursement associated with housing, relocation and travel allowance pursuant to their respective employment agreements.Company’s former Executive Vice President, Chief Financial Officer, retired from the Company effective as of June 1, 2018. Mr. Siegel was elected as the Company’s Executive Vice President, Chief Financial Officer effective as of June 4, 2018. |

2018 Grants of Plan-Based Awards

The following table sets forth information concerning grants of non-equity and equity incentive awards to the NEOs under the Company’s Amended and Restated Executive Bonus Plan and the

Amended and Restated Omnibus SIP for the year ended December 31,

2015. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Grant

Date | | | Committee

Action

Date(1) | | | Estimated Possible Payouts

Under Non-Equity Incentive

Plan Awards(2) | | | Estimated Possible

Payouts Under Equity

Incentive Plan Awards(3) | | | All Other

Stock

Awards:

Number

of Shares

of Stock

or

Units (#) | | | All Other

Option

Awards:

Number of

Securities

Underlying

Options

(#) | | | Exercise or

Base Price

of Option

Awards

($/Sh) | | | Grant

Date Fair

Value of

Stock and

Option

Awards

($)(4) | |

| | | | Threshold

($)(2) | | | Target

($)(2) | | | Maximum

($)(2) | | | Threshold

(#)(3) | | | Target

(#)(3) | | | Maximum

(#)(3) | | | | | |

Jeremy J. Male | | | 2/19/2015 | | | | 2/19/2015 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 419 | (5) | | | — | | | | — | | | | 12,499 | |

| | | 2/19/2015 | | | | 2/19/2015 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 50,335 | (6) | | | — | | | | — | | | | 1,501,493 | |

| | | 2/19/2015 | | | | 2/19/2015 | | | | — | | | | — | | | | — | | | | 45,302 | | | | 75,503 | | | | 90,604 | | | | — | | | | — | | | | — | | | | 2,252,254 | |

| | | — | | | | — | | | | 675,000 | | | | 1,350,000 | | | | 2,700,000 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | | |

Donald R. Shassian | | | 2/19/2015 | | | | 2/19/2015 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 419 | (5) | | | — | | | | — | | | | 12,499 | |

| | | 2/19/2015 | | | | 2/19/2015 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 26,845 | (6) | | | — | | | | — | | | | 800,786 | |

| | | 2/19/2015 | | | | 2/19/2015 | | | | — | | | | — | | | | — | | | | 24,161 | | | | 40,268 | | | | 48,322 | | | | | | | | — | | | | — | | | | 1,201,194 | |

| | | — | | | | — | | | | 243,750 | | | | 487,500 | | | | 975,000 | | | | — | | | | — | | | | — | | | | | | | | — | | | | — | | | | | |

Clive Punter | | | 2/19/2015 | | | | 2/19/2015 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 419 | (5) | | | — | | | | — | | | | 12,499 | |

| | | 2/19/2015 | | | | 2/19/2015 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 10,067 | (6) | | | — | | | | — | | | | 300,299 | |

| | | 2/19/2015 | | | | 2/19/2015 | | | | — | | | | — | | | | — | | | | 9,060 | | | | 15,100 | | | | 18,120 | | | | — | | | | — | | | | — | | | | 450,433 | |

| | | — | | | | — | | | | 206,250 | | | | 412,500 | | | | 825,000 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | | |

Andrew Sriubas | | | 2/19/2015 | | | | 2/19/2015 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 419 | (5) | | | — | | | | — | | | | 12,499 | |

| | | 2/19/2015 | | | | 2/19/2015 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 10,067 | (6) | | | — | | | | — | | | | 300,299 | |

| | | 2/19/2015 | | | | 2/19/2015 | | | | — | | | | — | | | | — | | | | 9,060 | | | | 15,100 | | | | 18,120 | | | | — | | | | — | | | | — | | | | 450,433 | |

| | | — | | | | — | | | | 206,250 | | | | 412,500 | | | | 825,000 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | | |

Richard H. Sauer | | | 2/19/2015 | | | | 2/19/2015 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 377 | (5) | | | — | | | | — | | | | 11,246 | |

| | | 2/19/2015 | | | | 2/19/2015 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 7,651 | (6) | | | — | | | | — | | | | 228,229 | |

| | | 2/19/2015 | | | | 2/19/2015 | | | | — | | | | — | | | | — | | | | 6,886 | | | | 11,476 | | | | 13,771 | | | | — | | | | — | | | | — | | | | 342,329 | |

| | | — | | | | — | | | | 118,750 | | | | 237,500 | | | | 475,000 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Committee Action Date(1) | | Estimated Possible Payouts Under Non-Equity Incentive Plan Awards(2) | | Estimated Possible Payouts Under Equity Incentive Plan Awards(3) | | All Other Stock Awards:Number of Shares of Stock or Units (#) | | All Other Option Awards: Number of Securities Underlying Options (#) | | Exercise or Base Price of Option Awards ($/Sh) | | Grant Date Fair Value of Stock and Option Awards ($)(4) |

| Name | | Grant Date | | | Threshold ($)(2) | | Target ($)(2) | | Maximum ($)(2) | | Threshold ($)(3) | | Target ($)(3) | | Maximum ($)(3) | | | | |

| Jeremy J. Male | | 2/22/2018 | | 2/22/2018 | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 65,055(5) |

| | — |

| | — |

| | 1,399,984 |

|

| | | 2/22/2018 | | 2/22/2018 | | — |

| | — |

| | — |

| | 58,550 |

| | 97,583 |

| | 117,100 |

| | — |

| | — |

| | — |

| | 2,099,986 |

|

| | | — | | — | | 675,000 |

| | 1,350,000 |

| | 2,700,000 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Matthew Siegel | | 6/4/2018 | | 6/4/2018 | | — |

| | — |

| | — |

| | — |

| — |

| — |

| — |

| — |

| | 15,045 |

| | — |

| | — |

| | 299,997 |

|

| | | — | | — | | — |

| | — |

| | — |

| | — |

| — |

| — |

| — |

| — |

| | — |

| | — |

| | — |

| | — |

|

| | | — | | — | | 140,908 |

| | 281,815 |

| | 563,630 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Andrew R. Sriubas | | 2/22/2018 | | 2/22/2018 | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 37,174(5) |

| | — |

| | — |

| | 799,984 |

|

| | | 2/22/2018 | | 2/22/2018 | | — |

| | — |

| | — |

| | 33,457 |

| | 55,762 |

| | 66,914 |

| | — |

| | — |

| | — |

| | 1,199,998 |

|

| | | — | | — | | 276,250 |

| | 552,500 |

| | 1,105,000 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Clive Punter | | 2/22/2018 | | 2/22/2018 | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 15,334(5) |

| | — |

| | — |

| | 329,988 |

|

| | | 2/22/2018 | | 2/22/2018 | | — |

| | — |

| | — |

| | 13,801 |